Our Story

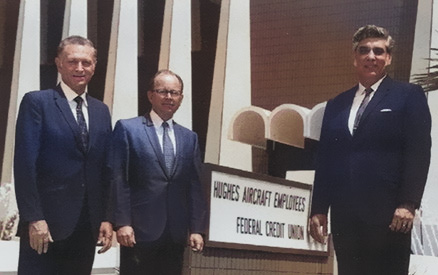

In 1940, 12 engineers at Hughes Aircraft, the aviation company formed by Howard Hughes, decided to open a credit union right in the plant. Each chipped in $5 to form the Hughes Aircraft Employees Federal Credit Union, with assets of $60 and first reported net income of one cent. The name Kinecta—suggesting kinetic energy and connection with our members—was formally adopted in 2001.

From its earliest days, the credit union’s mission was to be “the preferred and most trusted lifelong financial partner in the communities we serve.”

In 2021, Kinecta merged with Xceed Financial Credit Union, which grew out of Xerox Federal Credit Union and traces its history in the Rochester, NY, community back to 1931 when it was known as Rochester Postal Credit Union.

Kinecta Today

Today, Kinecta Federal Credit Union (Kinecta) is one of the nation's largest credit unions, proudly serving over 270,000 member-owners with assets of $6.8 billion. Our 800+ employees serve members and 440 employer groups from 23 branches, a variety of specialty offices and call centers on both coasts.

Our mission is to guide our members and communities to financial security. In practice, we act as our members’ personal financial consultants, offering them a range of products and services tailored to their needs and empowering them to live their best financial lives.

With secure and convenient banking options like online and mobile banking, virtual appointment or in-branch appointment service, over 5,800 shared credit union branches and more than 85,000 fee-free ATMs1 nationwide, our members have the flexibility to bank wherever they are.

In 2024, Kinecta received recognition from several publications, including the LA Times, which identified us as one of the top five credit unions headquartered in Southern California based on asset size. Newsweek named Kinecta one of America’s best Regional Credit Unions in 2024, and we were voted the Best Credit Union in the South Bay in Easy Reader’s 2024 “Best of the Beach” poll.

Banking Done Different®

At Kinecta, we focus on the human side of banking, seeing people over numbers, prioritizing member needs, and reinvesting our earnings for member and community benefit - that’s banking done different®

In addition to our banking, lending, insurance2 and wealth services3, Kinecta prioritizes giving back to the communities our members and employees call home. In 2023, Team Kinecta volunteered more than 7,000 hours at over 200 community events and, along with our members, raised more than $1,200,000 to support community-based programs.

Kinecta is dedicated to promoting a diverse, inclusive and equitable environment for our employees, members and the communities we serve. Our Diversity Council works to advance diversity, equity and inclusion (DEI) goals at Kinecta. Read more.

Executive Team

Our leadership team provides a comprehensive array of financial services and constantly strives to improve the services, convenience and support we offer to our member-owners and communities.

Executive Team Board of DirectorsBecome a Member

When you join Kinecta, you join a credit union where you can expect outstanding service, plus great rates on savings, credit cards, mortgage and vehicle loans.

Open An Account

Joining Kinecta is fast and easy. Apply for membership today.

Kinecta Federal Credit Union is a federally chartered credit union regulated by the NCUA. To address concerns related to Kinecta, please contact:

National Credit Union Administration

Office of Consumer Protection (OCP) & Division of Consumer Compliance and Outreach (DCCO)

1775 Duke Street, Alexandria, VA 22314

1ATM fees. No surcharge fee for Kinecta and affiliated credit union CO-OP and Allpoint ATMs. Unaffiliated ATM owners/operators may assess a fee.

2Insurance products offered through InsureOne Insurance Services America, LLC dba Kinecta Insurance Services, (CA Lic #0M04446) Insurance products: 1) are not NCUSIF insured; 2) are not obligations of or guaranteed by the Credit Union or any affiliated entities; 3) involve investment risk, including possible loss of value. Insurance products not available in all states. Actual policy premium may vary based on driving records, garaging address, vehicle type, insurance coverage selected and other underwriting factors. Other rates, service fees, restrictions and charges may apply.

Not FDIC or NCUA Insured

No Financial Institution Guaranteed

May Lose Value

3We have a partnership with Ameriprise Financial Services to provide financial planning services and solutions to our clients. We are not an investment client of Ameriprise, but we have a revenue sharing relationship with them that creates a conflict of interest. Details on how we work together can be found on ameriprise.com/sec-disclosure.

Ameriprise Financial Planning Services are optional, offered separately, and priced according to the complexity of your case and your financial advisor’s practice fee schedule. Your fees and financial advisor may be subject to change. Financial planning is generally appropriate if you have financial goals, sufficient assets and income to address your financial goals, and are willing to pay an investment advisory fee for recommendations to help you achieve those goals. Please review the Ameriprise Financial Planning Client Disclosure Brochure or, for a consolidated advisory relationship, the Ameriprise Managed Accounts and Financial Planning Service Disclosure Brochure, for a full description of services offered, including fees and expenses.

Ameriprise Financial, Inc. and its affiliates do not offer tax or legal advice. Consumers should consult with their tax advisor or attorney regarding their specific situation.

The financial institution and Ameriprise Financial, Inc. are not affiliated.

Kinecta Wealth Management is a financial advisory practice of Ameriprise Financial Services, LLC.

Investment advisory products and services are made available through Ameriprise Financial Services, LLC, a registered investment adviser.

Securities offered by Ameriprise Financial Services, LLC. Member FINRA and SIPC.