Frequently Asked Questions

General

What is the difference between member number and 14-digit account number?

Member Number: This number is given to all members who establish a membership with Kinecta Federal Credit Union. Under the member number, you can open other products such as additional savings accounts, checking accounts, share certificates, IRAs, loans, etc.

14-digit account number (also known as the MICR Number): This is a set of numbers that identifies a specific account type to debit or credit. For Direct Deposit and/or automatic payments, please provide the merchant with the 14-digit account number for the specific account you are setting up and ensure all numbers are used.

How do I find my member number?

Your member number is given to all members who establish a membership with Kinecta. Under the member number, you can open other products such as additional savings accounts, checking accounts, share certificates, IRAs, loans, etc.

To find your member number, follow these steps:

- Log in to online banking or open the app

- Go to the Accounts tab and select eDocuments

- Click on an Account Statement and a PDF will open

- Your Member Number appears in the top right corner

How do I find my account number and Kinecta’s routing number?

Your account number (also known as the MICR Number) is a set of numbers that identifies a specific account type to debit or credit. For Direct Deposit and/or automatic payments, please provide the merchant with the 14-digit account number for the specific account you are setting up and ensure all numbers are used.

To find your account number or routing number, please follow these steps:

- Log in to online banking or open the app

- Select the specific account you would like to obtain the information or go to the Accounts tab

- In the sub-navigation, select Account Details (or select Show Details in mobile)

- You will find your MICR (Account Number), and Routing Number listed

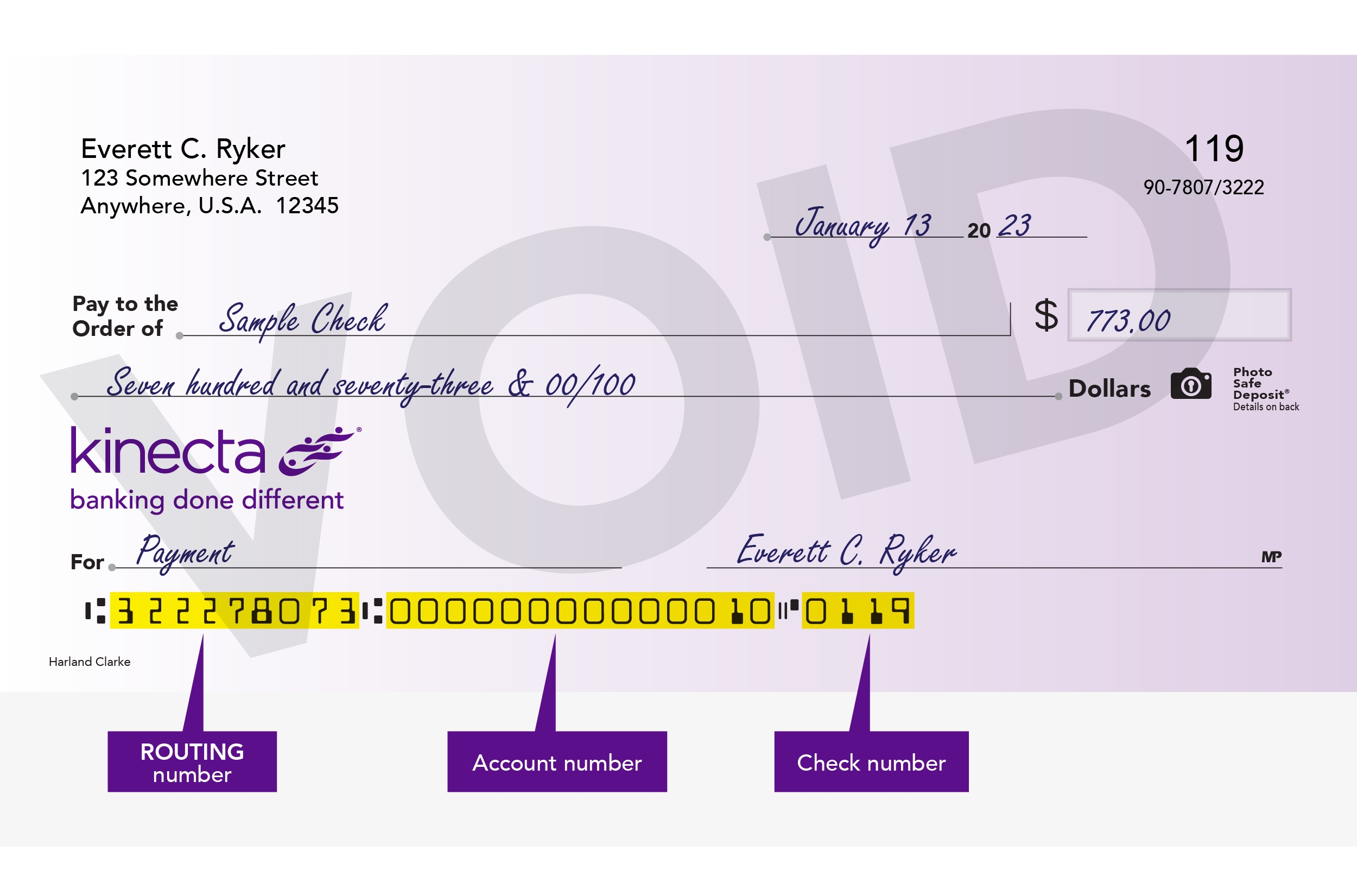

You can also find your account and routing number on your Kinecta checks located here:

Online & Mobile Banking

How do I enroll in online or mobile banking?

You can enroll online on your computer or download our mobile app. Once enrolled, your login will be the same regardless of what device you use.

To start online, simply go to kinecta.org, click the Log In drop-down and select Enroll in Online Banking. Then, follow the steps to complete your enrollment.

To start in the mobile app, search “Kinecta” in the App Store® or Google Play®. Once downloaded, open the app and select Enroll in Online Banking to follow the steps to complete your enrollment.

Your password must meet the following requirements:

- Minimum 8 characters

- Must contain a number

- Must contain a lowercase letter

- Must contain an upper-case letter

- Must contain a special character. Allowable special characters are _~@#$%^&*+=`|{}:;!.?

To maintain the security of your Kinecta account, please do not set your browser to pre-fill your username or password.

What are the browser requirements for using online or mobile banking?

To ensure optimal experience, performance and support, Kinecta's online and mobile banking system requires updated versions of the browsers listed here.

Why can't I use a simple password?

Federal regulations and Kinecta security standards are in place to provide protection for your account from hackers. Using a strong password with a variety of characters ensures that your password is not easy to guess and provides protection against criminal password generators. Other factors to consider when setting your password are as follows:

- Do not use common information that pertains to you, such as birth date, kids’ names, etc.

- Special characters such as !, &, and $, help strengthen your password.

- Never use a Social Security Number or any State Identification Number as your username or password.

For further information on fraud prevention, visit Kinecta’s Security Center.

What if I can’t remember my username or password?

If you don’t remember your password or username, simply click Forgot Password or Username on the login screen online or in the app.

You can also contact us by sending us a chat from kinecta.org or calling our Member Contact Center at 800.854.9846 within the US or 310.643.5400 for international.

Can I update my username and password?

Yes. You can change your username or password under Settings.

If you forget your username or password, you can also click Forgot Password or Username on the login screen online or in the app.

Can I unlock my account without changing my password?

Yes. You can contact us by sending us a chat from kinecta.org or calling our Member Contact Center at 800.854.9846 within the US or 310.643.5400 for international.

Why do I need to provide a verification code when I log in?

Kinecta uses a sophisticated two-factor or multi-factor authentication process to confirm your identity and help protect your account (and data) from hackers. You may receive a phone call or a text message or use an authenticator app with an access code. Once you receive your access code, simply enter it into the space provided. Never share this code with anyone, even if they claim to be with Kinecta.

How can I set up/update my multifactor authentication settings?

To set up or update your multifactor settings, click on Tools and then Settings, and Security. Select the Two-Factor Authentication section and use the pencil icon to enroll or edit your settings.

How do I change my contact information in online or mobile banking?

To change your contact information, click on Settings under Tools and then select the Contact section. Use the pencil icon next to any of the contact items to edit.

Can a joint owner use online or mobile banking?

Yes. Joint owners can enroll and use online or the mobile app.

I have a joint account; will I need a separate login to see that account?

No, you should see all the accounts you have ownership of under one login.

Does the mobile app work on tablets/iPads?

Yes. You can download the app to your tablet or iPad.

Can I change the language of digital banking?

Not at this time. We are exploring offering digital banking in Spanish in the future.

Where can I learn more about using online or mobile banking?

We have a library of Digital Banking Tutorials you can access to learn more about using Kinecta’s tools.

Wealth Management Accounts in Digital Banking

When you log in from a desktop browser, your Wealth Management account balances appear directly on your dashboard after logging in and accepting the Terms and Conditions. Account balances will also appear under the Investments menu by selecting Wealth Management.

Wealth Management balances are accessible by tapping More, then selecting Investments and Wealth Management in the Kinecta app menu and accepting the Terms and Conditions.

No. The previous end-of-day value will display. For the most current balance value, log in to the Ameriprise secure site.

Yes. Any individual with a direct role in the investment account will see it in their online banking view.

Only investment accounts in which you are listed as an owner of the account will be shown. This may be fewer accounts than what you can view on the Ameriprise secure site. Log in to the Ameriprise site to view accounts at the household level.

Investment products are not insured by the FDIC, NCUA or any federal agency, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value.

Kinecta Federal Credit Union is not affiliated with Ameriprise Financial, Inc.

Kinecta Wealth Management is a financial advisory practice of Ameriprise Financial Services, LLC. Investment advisory products and services are made available through Ameriprise Financial Services, LLC, a registered investment adviser.

Securities offered by Ameriprise Financial Services, LLC. Member FINRA and SIPC.

Self-Directed Digital Investing

Kinecta is transitioning from Arete Wealth Management, LLC to Green Pier Fintech LLC.

When is this change happening?

The transition will begin on Thursday, December 18, 2025. You will have until Monday, December 29, 2025 to open your new account and initiate your transfer.

What do I need to do to transfer my account?

- Log in to Kinecta’s online banking and select Digital Investing under the Investments menu. The application will be pre-filled with your existing account information. By submitting this application, your new brokerage account is established with Green Pier Fintech LLC.

- Electronically sign the Transfer of Assets form via DocuSign from Green Pier Fintech LLC from the email associated with your account. Your cash and positions will transfer from Arete to Green Pier Fintech LLC. This transfer takes approximately one week. You will not be able to transact or trade in your Arete account. Note: To process the transfer of assets, the delivering firm requires any fractional shares in your account be liquidated by you before submitting the transfer form.

Do I need to relink my bank account?

Yes, you will need to relink your bank account. This can be done once you have established your new Green Pier brokerage account.

How will I access both accounts until the positions have moved?

All active accounts will be displayed on your dashboard and in My Accounts under Profile & Settings. Once an account has been closed, it will only display in the My Accounts under Profile & Settings.

How will I access historical documents, such as tax documents and account statements on my Arete account?

All tax documents will be accessible through the Communications page while viewing your brokerage account online.

Who do I contact if I have additional questions about my brokerage account?

If you have questions during this process, please email Green Pier at service@greenpier.com or call 833.486.1816. Please note this contact information for future use.

If Kinecta’s online banking is not available, how can I access my digital investing account?

Visit digitalinvesting.kinecta.org. For additional support, email Green Pier at service@greenpier.com or call 833.486.1816.

If I have an automated investing account, will that also transition?

No, only the self-directed accounts are transitioning during this time. We will be moving the digitally advised account at a later date.

Does this transition cost me anything?

No, it will not cost you anything to transition.

What will happen if I do not open an account with Green Pier?

f you choose not to open an account with Green Pier Fintech LLC, your existing self-directed digital investment account with Arete Wealth Management, LLC will be liquidated and closed.

How long will I have to open my Green Pier account?

You will have until Monday, December 29, 2025, to open your account and initiate your transfer.

Account History

I would like to search for a specific transaction on my account. What do I need to do?

From your Dashboard or Accounts view, select the account you wish to search under. Use the Search box to type in specific keywords in the Description and click enter. The search box is available on mobile by clicking the magnifying glass icon on the top right corner.

You can also locate transactions by filtering. On a desktop, click on the filter icon next to the Search box to filter by Date, Transaction Amount/Range, Credit or Debit, Type, Category or Check Number/Range. After making your selection, click Search. On mobile, you can select from the filter buttons listed below the Search box.

On a desktop, you can also sort transactions by Date, Description, Amount and Balance. Simply click the Sort By drop-down menu to make your selection.

I need a copy of my Kinecta Credit Card Agreement. How can I obtain a copy?

To obtain a copy of your Kinecta Credit Card Agreement, please contact us by sending us a chat from kinecta.org or calling our Member Contact Center at 800.854.9846 within the US or 310.643.5400 for international. Or send us a secure message.

Transfers & Zelle®

How do I transfer money to an external account?

From the Transfers section, under Transfer & Pay, you can elect to transfer money between your accounts or to an external account at another financial institution (as long as you are the primary owner or an authorized signer). Simply select the account you want to transfer to and from using the drop-down menus. You can select Add An Account to add a new external account.

How do I transfer money to another Kinecta member?

From the Transfers section, under Transfer & Pay, you can elect to transfer money to another Kinecta member. Simply select the account you want to transfer to and from using the drop-down menus. You can select Add An Account to add a new Kinecta member.

If you are having trouble setting up a Cross Account to another member’s account, contact us by sending us a chat from kinecta.org or calling our Member Contact Center at 800.854.9846 within the US or 310.643.5400 for international. Or send us a secure message.

How do I enroll in Zelle®?

- Log in to the Kinecta mobile banking app

- Under More, select Zelle®

- Enroll your email address or U.S. mobile number

- You’re ready to start sending and receiving money with Zelle®

Learn more about Zelle®, including FAQs.

What are my options for funding a new account I opened online?

We have several ways you can fund new accounts you've opened online, depending on the account type, funding limits and your preference.

If you choose to use our third-party service to fund your account(s) after opening, please note the following:

- Any account type can be funded with this service, including savings, checking, all certificates, and money market accounts.

- This service uses a secure connection, which requires you to log into your financial institution. If you want to fund from a Kinecta account using this service, you must re-enter your login credentials.

- Members can fund up to three accounts at a time using this service, but they must fund all accounts using the same method (ACH or debit/credit card).

- ACH funding is limited to $100,000

- Debit and credit card funding is limited to $500.

- Funding with Kinecta credit cards through this service is not available.

If you prefer to fund your account(s) using Kinecta's online or mobile banking, please note the following:

- There are two ways to transfer funds to your new account(s) in online or mobile banking: transfer between Kinecta accounts or external transfer from another financial institution (ACH)

- Transfers between Kinecta accounts are immediate, and there is no limit on the amount.

- External transfers may take 2-3 business days to process, and setting up external accounts may require validating trial deposits. Incoming transfer limits are as follows:

- Daily: $20,100

- Weekly: $40,200

- Monthly: $40,200

- Promotional, regular and jumbo certificates cannot be funded in online or mobile banking. Liquid certificates can be funded.

If you need assistance funding your accounts, you can also call us, send us a secure message in online or mobile banking, use live chat or visit a branch.

Online Payments

Can I make an online transfer payment to my first mortgage, second mortgage (HELOC), consumer loan or credit card account?

Yes, you can. See below for additional information:

First Mortgage

Online payments to your Kinecta first mortgage account from an internal Kinecta account will be processed on the same day*; however, if the payment is received before 1 p.m. (PT), it will display in online banking in one business day. If the payment is made after 1:01 p.m. (PT), it will display in online banking in two business days. There is a 15-day grace period before a late fee is assessed.

If you would like to speak to a representative regarding your Mortgage Loan account (including payoff information), please call the Loan Servicing Department at 877.896.8525. Representatives are available Monday through Friday, 8 a.m. to 5 p.m. PT (11 a.m. to 8 p.m. ET).

*If a partial payment is made, it will be held in a holding account until a full payment is received.

Second Mortgage (HELOC)

Online payments to your second mortgage will be applied to the account immediately or on the selected date of the transfer if the payment is made from a Kinecta account. Payments made from external accounts typically take 2–3 business days.

Payments received and/or posted by Kinecta within one day of a statement date and not reflected on that statement will appear on your next statement.

If you would like to speak to a representative regarding your Second Mortgage account, please call our Member Contact Center at 800.854.9846 within the US or 310.643.5400 for international.

To pay off your second mortgage (HELOC) account, contact Loan Services at 800.854.4501, option 3, option 2 for further instructions. Representatives are available to help Monday through Friday, 8 a.m. to 5 p.m. PT (11 a.m. – 8 p.m. ET).

Consumer Loan

Online payments and payoffs to your consumer loan (e.g., vehicle loan, personal loan, etc.) will be applied to the account immediately or on the selected transfer date.

If you would like to speak to a representative regarding your Consumer Loan account, please call Loan Services at 800.854.4501, option 3, option 2. Representatives are available to help Monday through Friday, 8 a.m. to 5 p.m. PT (11 a.m. – 8 p.m. ET).

Credit Card

For online payments made after 3 p.m. (PT), the payment will be displayed on the credit card account on the following business day.

If you have questions about your credit card account, please call 877.881.6023 within the US or 310.643.2106 internationally. Representatives are available 24/7.

Bill Pay

Please contact Bill Pay Support at 855.224.0852, Monday through Friday from 4:30 a.m. – 9 p.m. PT.

eDocuments

What types of eDocuments can I download online?

eDocuments are available online for the primary owner. The current eDocuments we offer are:

- Account Statements

- Credit Card Statements

- Loan Statements

- All consumer loans (excluding first mortgages)

- First Mortgage statements are located in the Mortgage Portal by selecting Mortgage under Accounts in the main navigation

- Notices

- Tax Documents

- 1099 - IRA Withdrawals

- 5498 - IRA Contributions

- 1099INT - Interest Income

- 1042S - Foreign Person's US Source Income Subject to Withholding

- 1098 - Mortgage Interest Statement (Please Note: This is only available in the Mortgage Portal by selecting Mortgage under Accounts in the main navigation)

How long will each document be available online?

Account, Loan and Credit Card Statements will be available for up to three years. Notices will be available for the last three months. Tax Documents will be available for the two most recent tax years.

You may request previous Statements and Tax Documents by contacting Member Support via a secure message through online banking, calling the Member Contact Center at 800.854.9846 or visiting your local Kinecta branch.

What are the requirements to receive electronic (paperless) statements?

To enroll in eDocuments, a current email address is required. To add or update an email address to your account, please follow these steps:

- Log in to online banking or open the app

- Click on Tools (under More in mobile), and select Settings

- Under the Contact section, click on the pencil next to Email

- Enter the email address

- Click Save Changes

How do I change my delivery preference for statements, notices and tax documents?

Please follow these steps:

- Log in to online banking or open the app

- Click on Accounts (under More in mobile), and select eDocuments

- Under Subscription Settings, click the drop-down to select the gear icon

- Select your delivery preference

- Click Continue

- Complete the steps to agree to the eDocuments Disclosure and view PDFs

- Click Save

You are now enrolled in eDocuments.

How do I enroll into eDocuments for first mortgage accounts?

To go paperless for your first mortgage account:

- Log in to online banking or open the app

- On your Account Dashboard, locate and select your mortgage loan

- Select the box for Go Paperless Today and Enroll Today

- Turn the Paperless Billing option on and click Update

- Review the eStatement Policy, check the box to Agree, and select Accept Terms

You can take the same steps to cancel paperless statements.

How do I view eDocuments from prior months?

To view your eDocuments from previous months:

- Log in to online banking or open the app

- Click on Accounts (under More in mobile), and select eDocuments

- Select from the Statements, Notices or Tax Documents tabs

- Click the name of the document you would like to view

To view your statements online, the browser’s pop-up blockers must be turned off.

Am I able to change my document preferences back to paper documents?

If you choose to revert back to paper documents, you can do so using the same instructions. A $2 fee may apply for paper Account Statements.

Check Copies

I need a copy of a check that cleared my account. How can I view the check?

To view and/or print cleared checks, please follow the steps below:

- Log in to online banking or open the app

- Select the checking account on your Dashboard to view transactions

- Under Additional Filter options select Checks under the Show Only dropdown

- Under Check Number you may select the specific check numbers you would like to view and/or print; or leave blank for a list of all check numbers

- Click Submit

- Double-click on the check icon to view the image

- To print the check image, click on the printer icon. Please note, to view check copies online, the pop-up blockers must be turned off. Please visit your browser settings to ensure the pop-up blockers are not enabled.

You can also call our Member Contact Center at 800.854.9846 within the US or 310.643.5400 for international.

Checks converted to an electronic payment are not available. If you require proof of payment, you can print a copy of your statement (available online for free) or you can print a copy of your transaction history screen.

Mortgage Information in Online Banking

How do I sign up for electronic (paperless) mortgage statements for my first mortgage?

To go paperless for your first mortgage account:

- Log in to online banking or open the app

- On your Account Dashboard, locate and select your mortgage loan

- Select the box for Go Paperless Today and Enroll Today

- Turn the Paperless Billing option on and click Update

- Review the eStatement Policy, check the box to Agree, and select Accept Terms

You can take the same steps to cancel paperless statements.

Can I set up alerts for my mortgage in online and mobile banking?

Yes. You have many options for receiving email and text alerts, including when your mortgage statement is available. To set up or modify alerts:

- Log in to online banking or open the app

- On your Account Dashboard, locate and select your mortgage loan

- Click the Mortgage Portal tab

- Select Profile located at the right corner of the screen

- Select Communications and select the pencil to make your selection or modify your preferred alerts.

How can I see more detailed information about my mortgage (e.g., recent activity, payments, etc.)?

To see more detailed information:

- Log in to online banking or open the app

- On your Account Dashboard, locate and select your mortgage loan

- Under View Transactions and Account Details you can find most information about your mortgage loan

- You can also click the Mortgage Portal tab to view Payments, Mortgage, Documents, Calculators and Help

Shared Branch & ATM Locations

How can I access my accounts when I am not near a Kinecta branch?

Beyond using online banking or Kinecta’s mobile app, you can also access your accounts using over 5,800 shared branches or over 85,000 fee-free* ATMs nationwide.

You can easily locate a shared branch or ATM by selecting Locations from the top right corner of online banking or from the main menu in mobile banking. Locations are also available on our website. To narrow down your results, enter your zip code or city and state and mark the appropriate boxes under Search Options.

*ATM fees. No surcharge fee for Kinecta and affiliated credit union CO-OP and Allpoint ATMs. Unaffiliated ATM owners/operators may assess a fee.