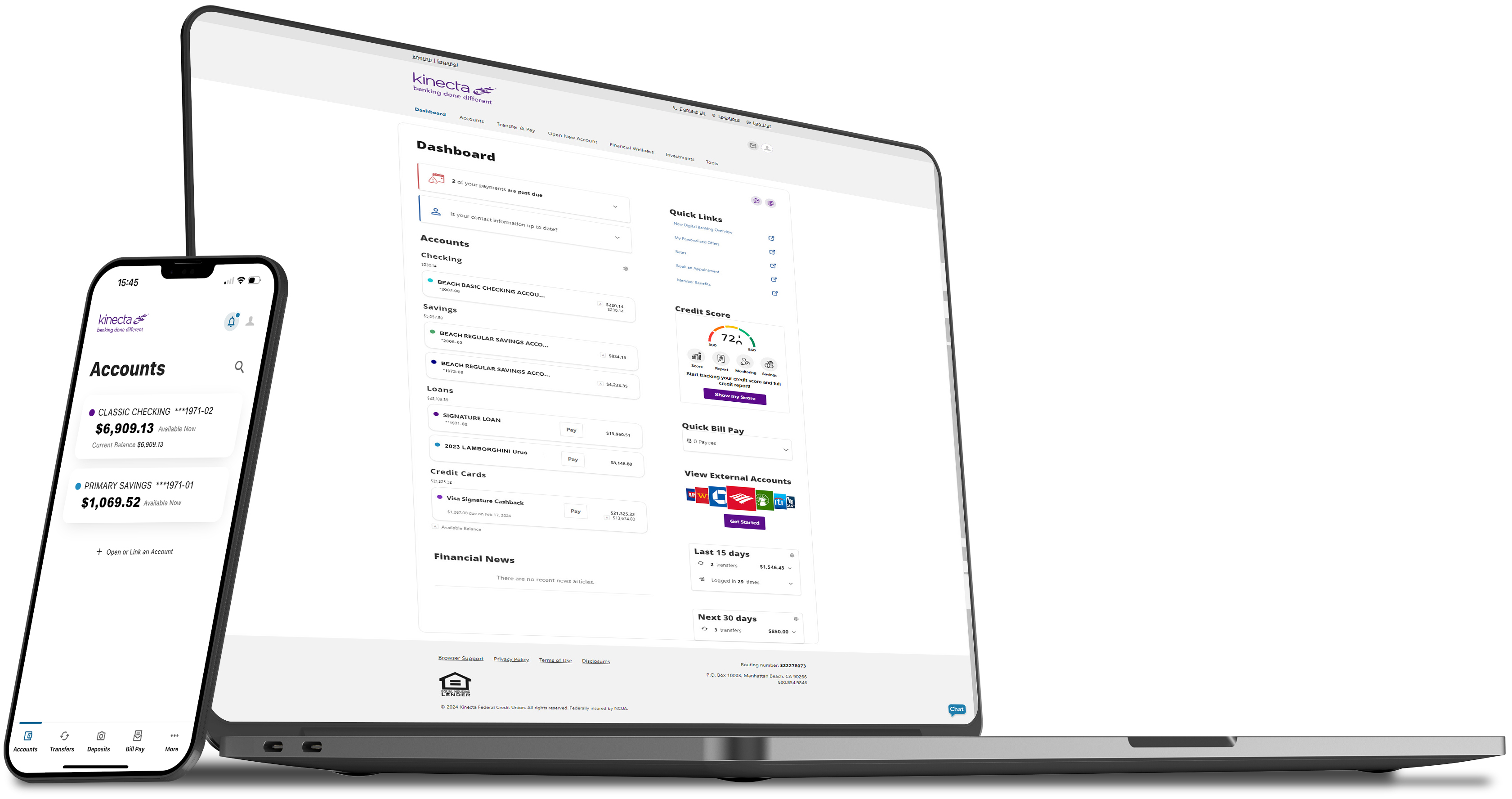

Kinecta's upgraded digital banking is faster, easier and smarter than ever. View the video to learn more.

New Features Designed with You in Mind ›

Explore new features and enhancements in the new digital banking.

How to Log In and More

Learn how to log in, download the app and more with interactive demos.

Simple How-To Demos ›

Explore interactive demos and videos created for you to get the most from your digital banking.

Frequently Asked Questions ›

We’re here to help. Check out our FAQs for more information about the new digital banking.

New Features Designed with You in Mind

- New Look & Feel – Enjoy an updated design with easy-to-find features.

- Unified Experience – Access a consistent experience and features on your desktop, tablet or phone.

- Account Personalization – Create your own unique view to navigate with ease.

- Link External Accounts – Track your accounts, even ones not with Kinecta, in one secure place.

- Self-Service – Dispute transactions, manage overdraft protection and more.

- Bill Pay & Transfers – Linking new accounts and setting up payees has never been easier.

- Digital Cards – View full credit and debit card details for making online purchases.

- Card Management – Manage your PIN and more.

- Mobile Deposit – Upgraded technology auto-captures your check image.

- Advanced Security – Rest assured with customizable multi-factor authentication options.

- Analytics – Categorize transactions so you can track your spending over time.

- Financial Wellness – See your detailed spending analysis and set up savings goals.

- Alerts & Notifications – Stay on top of your finances with custom notifications and texts.

- In-App Statements – Conveniently access your statements online or in the app.

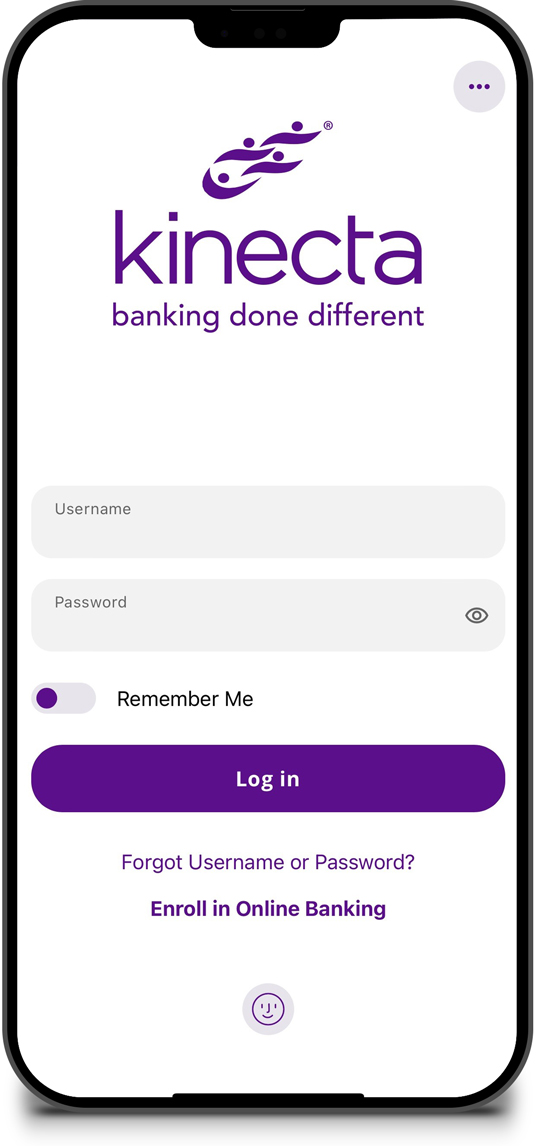

How to Log In

Log in on kinecta.org or in the app using your current username and password. For your security and protection, your password must meet standard minimum requirements, or you will be asked to change it when you first log in.

If you don’t remember your password or username, simply click “Forgot Password or Username” in the log in area online or in the app.

Check out these helpful how-to demos for more information:

- First Time Logging into Online Banking

- First Time Logging into Mobile Banking

- Forgot Username

- Forgot Password

Or review our Frequently Asked Questions to get your questions answered.

Frequently Asked QuestionsDownload the App

You will need to download the new mobile app to your device from the App Store® or Google Play®.

Check out this helpful how-to demo for more information:

Download our mobile app today.

Or review our Frequently Asked Questions to get your questions answered.Frequently Asked Questions

How to Use Digital Banking

Explore interactive demos and videos created for you to get the most from your digital banking. Our library offers you step-by-step instructions on how to access and complete the most common tasks in digital banking.

See all DemosFrequently Asked Questions

General

Do I need to do anything to get the new digital banking?

If you’re already an active user of online or mobile banking, you will log in the same way you always have.

You will log in with your current username and password. For your security and protection, your password must meet standard minimum requirements, or you will be asked to change it when you first log in.

To use the mobile app, you will need to download the new app to your device from the App Store® or Google Play®.

To log into online banking, you will need to use the log in box on the kinecta.org homepage.

When is the new digital banking available?

The new digital banking will be available on March 19.

Will I log in differently than before?

You will log in using the same username and password you've always used. For your security and protection, your password must meet standard minimum requirements, or you will be asked to change it when you first log in. If you don’t remember your password or username, simply click “Forgot Password or Username” in the log in area online or in the app.

To use the mobile app, you will need to download the new app to your device from the App Store® or Google Play®. To log into online banking, you will need to use the log in box on the kinecta.org homepage.

Who can I talk with if I have trouble with the new digital banking?

We’re here to help you with whatever questions you have. You can call us at 800.854.9846.

What are the browser requirements?

The new online banking works on the two most recent versions of Chrome, Safari, Firefox, and Edge browsers. The mobile app is available on Apple® and Android® devices using one of the two most recent operating systems.

How is the new digital banking different?

The new digital banking was designed to make your financial life easier with a new, easy-to-navigate look, consistent experience across online and mobile, new features designed to help you personalize your experience, and many self-service options.

Are there any current features that will be unavailable in the new digital banking?

Some small features will no longer be available, including Online Giving and Quicken Direct Connect. However, Quicken Express Web and Web Connect will be available in the new digital banking. For more information about these features, please call us at 800.854.9846.

How do I sign up for digital banking if I’ve never used online banking or the mobile app before?

You can easily sign up for the new digital banking on a computer or mobile device with the new app. Simply click “Enroll in Online Banking” in the login area and follow the steps to complete your enrollment.

Can I change the language of digital banking?

Not at this time. We are exploring offering digital banking in Spanish in the future.

Username & Password

What if I forgot my password or username?

If you don’t remember your password or username, simply click “Forgot Password or Username” on the login screen online or in the app.

Can I update my username and password?

Yes. After you log into the new digital banking, you are able to change your username or password under Settings. If you forgot your username or password, you can also click “Forgot Password or Username” on the login screen online or in the app.

Why am I being asked to create a new password when I first log in?

For your security and protection, your password must meet standard minimum requirements, or you will be asked to change it when you first log in.

Can a joint owner log in to the new digital banking?

Yes. Joint owners can continue to log in just as they always have, using the same account login credentials.

I have a joint account; will I need a separate login to see that account?

No, you will be able to see all the accounts you have ownership of under one login.

Mobile App

Do I need to update my mobile app?

Yes, after the upgrade, you will need to download the new mobile app to your device from the App Store® or Google Play®.

How do I log in on the mobile app?

Make sure you have the latest app installed on your phone — you will need to download the new mobile app to your device from the App Store® or GooglePlay®. Once you have the new app, simply log in using the same username and password you’ve always used. For your security and protection, your password must meet standard minimum requirements, or you will be asked to change it when you first log in. If you don’t remember your password or username, click “Forgot Password or Username.”

Will the new mobile app still recognize my Face or Touch ID?

If your device offers Face or Touch ID, you’ll be asked if you’d like to set this up with the new mobile app.

Does the mobile app work on tablets/iPads?

Yes. You can download the new digital banking app to your tablet or iPad.

Will Zelle® be available in the new digital banking?

Yes, Zelle® will continue to be available in the new digital banking using the mobile app. Please note that access to Zelle® for all users will be temporarily unavailable from March 13, 10 p.m. PT (1 a.m. ET) – March 19, 12 p.m. (3 p.m. ET) while we complete the upgrade.

Account Information

Why can I see joint accounts in my Dashboard, and can I remove them?

You will now be able to see all accounts you have ownership on, including joints, in your Dashboard and Account views. If you do not wish to see these accounts, you can easily hide them from your Dashboard or from your entire digital banking experience (e.g., Transfer and Pay sections). Check out this how-to demo to learn more: Hide and Unhide Accounts.

Will my accounts look the same when I log in?

All your account information will be transferred securely to the new digital banking. Once you log in, you’ll notice a change to the look and feel of your account dashboard.

Will my Bill Pay information carry over to the new digital banking?

Yes. All your payee and payment information will carry over. Please review your Bill Pay settings, just to be sure everything is correct.

Will my scheduled transfers carry over to the new digital banking?

Most scheduled transfers will be converted to the new digital banking. The exception is semi-monthly transfers not occurring on the 1st and 15th. Prior to the upgrade, you can delete the existing transfer and set it up again as semi-monthly occurring on the 1st and 15th or as two separate monthly transfers (to keep the same process date). If you don’t make these changes prior to the upgrade, then you can set up the transfers again in the new digital banking.

Will I need to set up my payees again?

No, existing payees and scheduled payments will appear in the new platform.

Where can I find my full account number(s) and Kinecta’s routing number?

In the new digital banking, you can find your full account number(s) and Kinecta’s routing number on the Accounts page in the Account Details section.

Will my secure messages carry over to the new digital banking?

No, past secure messages will not transfer to the new digital banking. Read, save and take any action on your messages before March 18 at 9 p.m. PT (12 a.m. ET).

You must complete two actions for your Quicken or QuickBooks settings to ensure your data connectivity transfers smoothly.

Follow the below instructions to access your transactions with Web Connect or Express Web Connect:

First Action: Before March 18

A data file backup and a final transaction download should be completed by March 18. Please complete the final download before March 18 since transaction history might not be available after the upgrade.

Second Action: After March 19

Complete the deactivation/reactivation of your online banking connection to ensure you get your current Quicken or QuickBooks accounts set up with the new connection after March 19.

Instructions

- Quicken Conversion Instructions

- QuickBooks Desktop Conversion Instructions

- QuickBooks Online Conversion Instructions

- Quicken for Windows Getting Started Guide

- Quicken for Mac Getting Started Guide

IMPORTANT: Express Web Connect may not be available until five business days after March 19, so please utilize another connectivity type if you need transaction updates during this downtime. There is no delay for Web Connect. Users are encouraged to download a QFX/QBO file during this outage.

Security

What will be my username and password for the new digital banking?

Your current username and password will transfer over to the new digital banking. For your security and protection, your password must meet standard minimum requirements, or you will be asked to change it when you first log in.

Why would I need to update my password for the new digital banking?

- Minimum 8 characters

- Must contain a number

- Must contain a lowercase letter

- Must contain an upper-case letter

- Must contain a special character. Allowable special characters are _~@#$%^&*+=`|{}:;!.?

Do I have to set up Face or Touch ID again?

If your device offers Face or Touch ID, you’ll be asked if you’d like to set this up with the new mobile app.

Does the new digital banking have multi-factor or two-factor authentication security?

Yes, the new digital banking has multi-factor authentication using either phone, text, email or an authenticator app. You will be able to edit your multi-factor settings under the Security section on the Settings page.

How is the new digital banking more secure?

The new digital banking has several new, advanced fraud detection monitoring tools to keep your account secure. Plus, with custom alerts and notifications, you can keep an even closer eye on your accounts at any time.

How can I help keep my account secure?

Business Members

What will be different for business members?

Business members will have the same features as retail members, with some exceptions (e.g., Zelle®). Business members will also be able to add sub-users.

Will sub-users on my business online banking account be moved to the new digital banking?

No. You will need to set up all sub-users on the new platform.

Will sub-users be able to use the “Forgot Username or Password” option to reset their credentials?

Business sub-users will need to work with the main business administrator to reset their password or username.

Am I able to use Zelle® with my business account?

No, Zelle® is not available to use for business accounts. You can use Bill Pay to make payments with your business account now or after the upgrade. Please note enrolling in Bill Pay will be temporarily unavailable from March 14, 10 p.m. PT (1 a.m. ET) – March 19, 12 p.m. (3 p.m. ET).